working capital funding gap formula

Click here to learn more about this topic. Working Capital Current Assets Current Liabilities.

How To Improve Working Capital With Efficient Credit Management

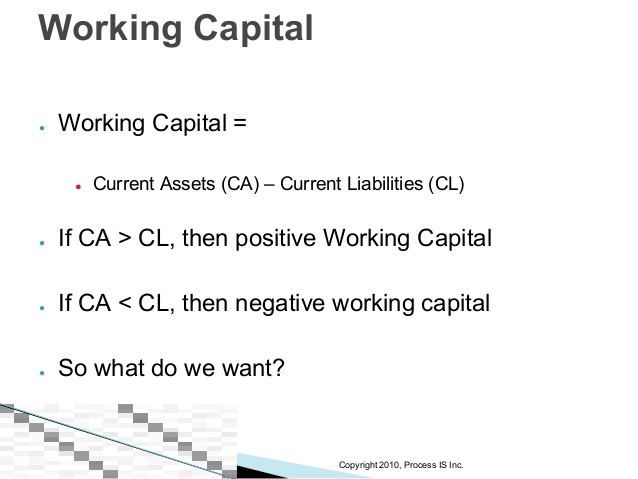

Working Capital Current Assets Current Liabilities.

. Working capital is calculated by using the current ratio which is current assets divided by current liabilities. This working capital ratio 2 is the sign of if. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

Ad Turn your outstanding invoices and accounts receivable into working capital. You divide the numbers instead of subtracting them to get a ratio. Working capital is the difference between current assets and current liabilities.

Finding your companys net working capital ratio is simple. Explanation of Working Capital. Get the financing and support you need to reach your business goals.

The formula for calculating working capital is as follows. Working Capital formula is defined under. 10000 Monthly Deposits Into Business Bank Account.

A ratio above 1 means current assets exceed liabilities and. 10000 Monthly Deposits Into Business Bank Account. Working Capital Current Assets Current Liabilities.

Working capital is equal to current assets minus current liabilities. Ad Up to 250k in 24 Hours For All Levels Of Credit Based On Cash Flow. Net Working Capital Current Assets Current Liabilities Working Capital Ratio Current AssetsCurrent Liabilities.

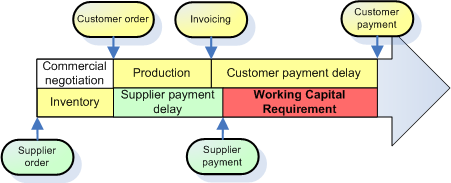

𝑇 𝑇 1𝑔 𝐴 𝑔 Where TV is the project terminal value 𝑇 is the after tax cash flow in the last year of the business plan g is the perpetual growth rate of cash flows starting from the last. Mind the gap a common phase I heard recently on the London Underground reminded me of one of the most fundamental issues faced by businesses currently the. Ad Up to 250k in 24 Hours For All Levels Of Credit Based On Cash Flow.

You will find this definition repeated. The formula is as follows. Current Assets - Current Liabilities Working Capital.

Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank. Working Capital INR 3464391 2560734 Working Capital INR 903657. It is a measure.

Working Capital Formula.

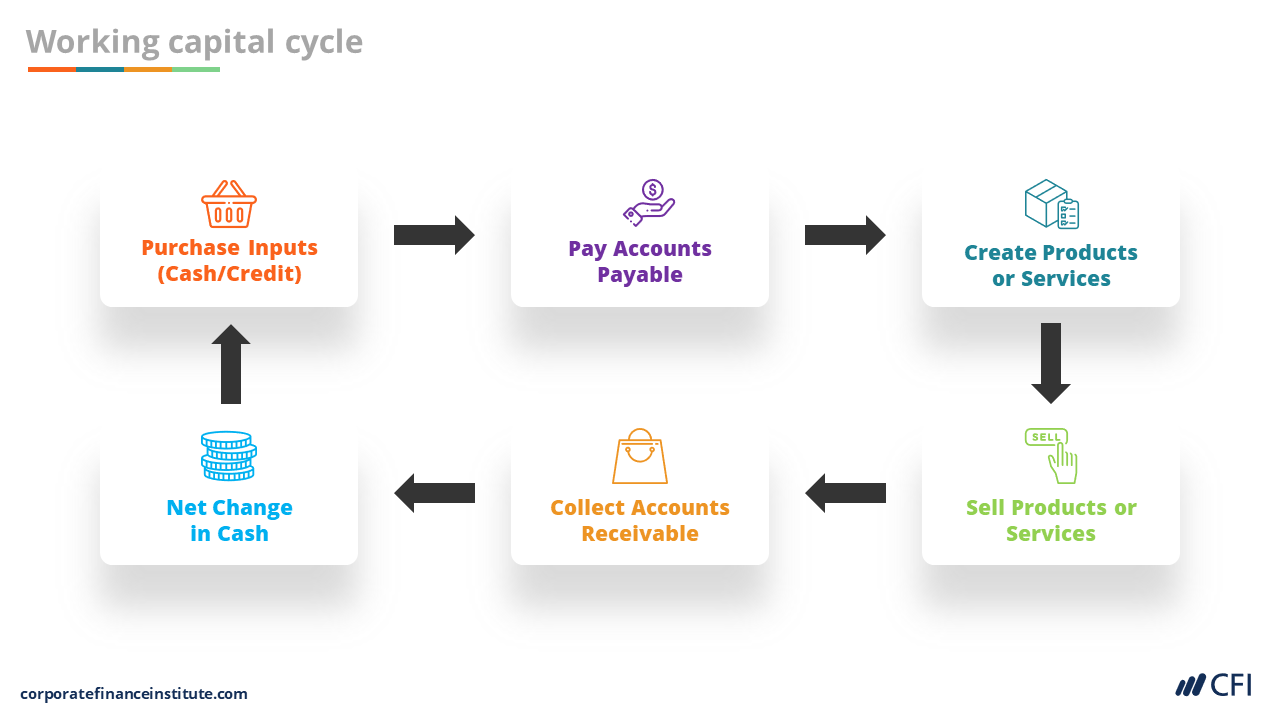

Working Capital Cycle Understanding The Working Capital Cycle

Efficiency Ratios Overview Uses In Financial Analysis Examples

How Early Payments Increase Your Working Capital Tradeshift

Working Capital Formula Youtube

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital What Is Working Capital Youtube

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Why You Need To Know The Working Capital Formulation And Ratio India Dictionary

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Cycle What Is It With Calculation

Types Of Working Capital Gross Net Temporary Permanent Efm

Working Capital Funding Gap Problem Water Cooler Analystforum

Working Capital Cycle Definition How To Calculate

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Cash Flow Cycles And Analysis Cfi

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)